Business Insurance in and around Sault Sainte Marie

One of Sault Sainte Marie’s top choices for small business insurance.

Cover all the bases for your small business

- Mackinac Island

- Newberry

- Kinross

- Brimley

- St Ignace

- Kincheloe

- Germfask

- Dafter

- McMillan

- Rudyard

- Eckerman

- Cedarville

- Barbeau

- Engadine

- Goetzville

- Drummond Island

- Pickford

- Curtis

- Hessel

- Naubinway

- Paradise

- Detour Village

- Gould City

- Grand Marais

Your Search For Great Small Business Insurance Ends Now.

Running a small business is no joke. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, contractors, specialized professions and more!

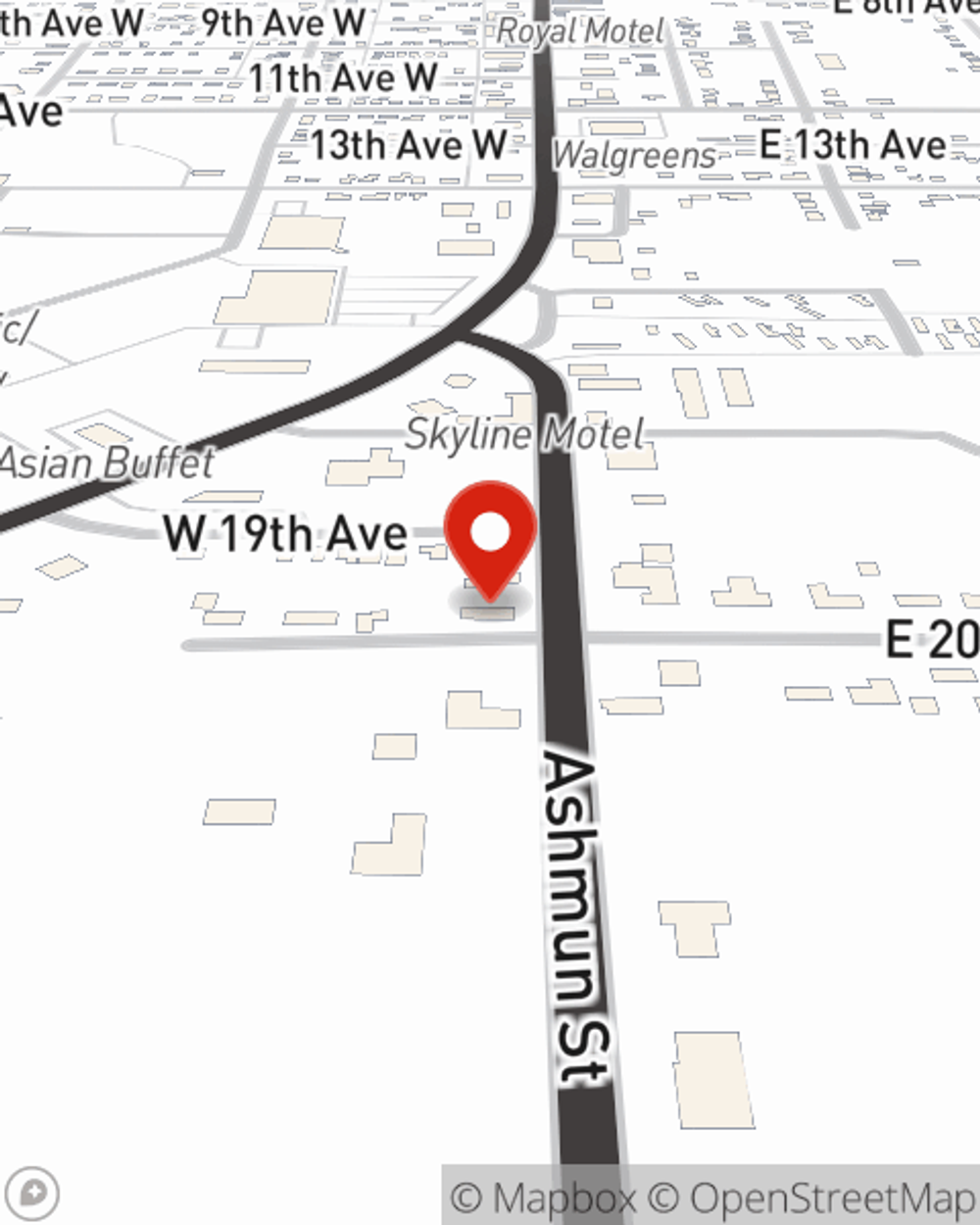

One of Sault Sainte Marie’s top choices for small business insurance.

Cover all the bases for your small business

Insurance Designed For Small Business

When one is as dedicated to their small business as you are, it is understandable to want to make sure everything is in order. That's why State Farm has coverage options for commercial auto, artisan and service contractors, surety and fidelity bonds, and more.

The right coverages can help keep your business safe. Consider getting in touch with State Farm agent Leisa Mansfield's office today to discover your options and get started!

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Leisa Mansfield

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.