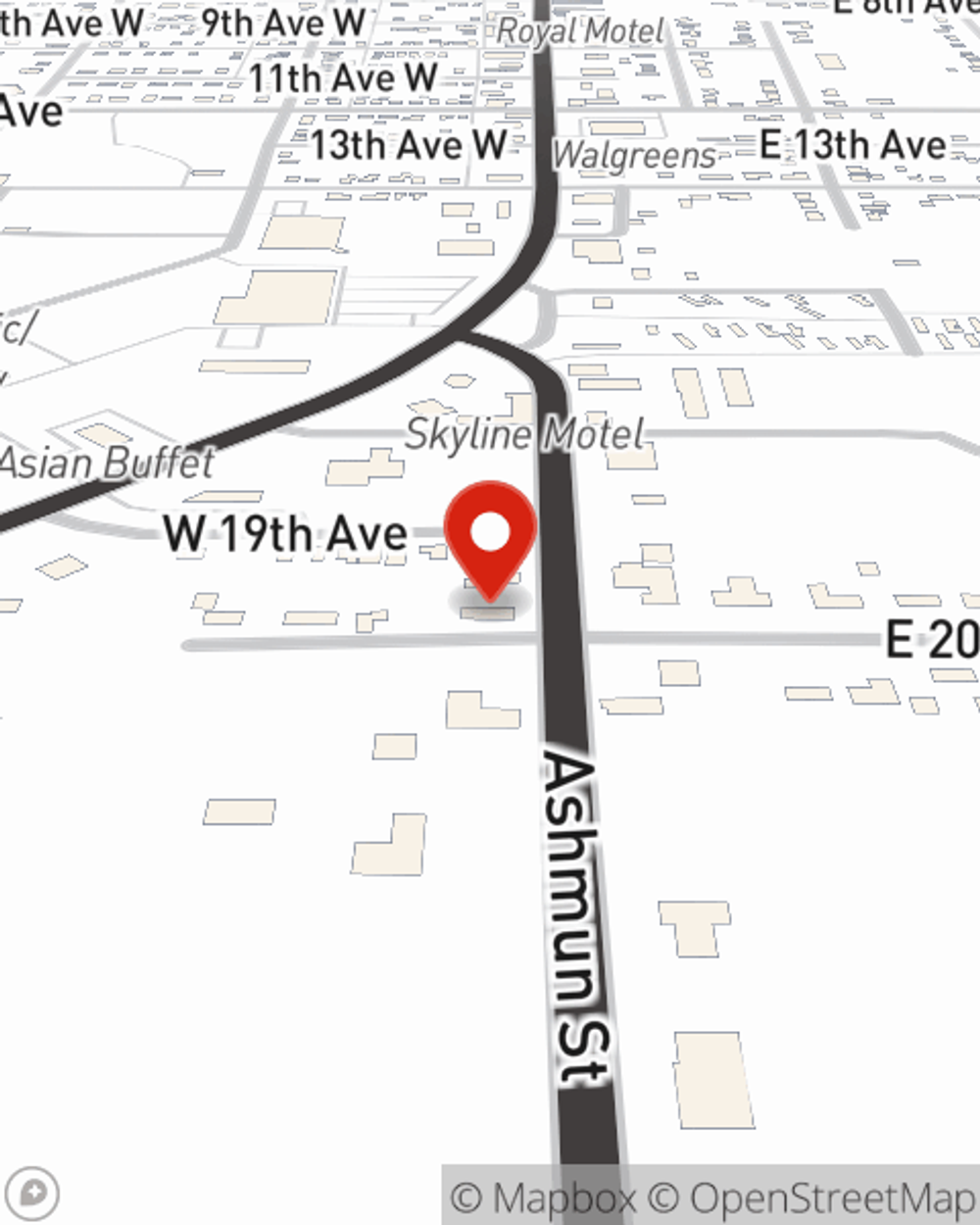

Life Insurance in and around Sault Sainte Marie

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Mackinac Island

- Newberry

- Kinross

- Brimley

- St Ignace

- Kincheloe

- Germfask

- Dafter

- McMillan

- Rudyard

- Eckerman

- Cedarville

- Barbeau

- Engadine

- Goetzville

- Drummond Island

- Pickford

- Curtis

- Hessel

- Naubinway

- Paradise

- Detour Village

- Gould City

- Grand Marais

It's Never Too Soon For Life Insurance

It can be what keeps you going every day to take care of your partner, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that the people you love can maintain a current standard of living and/or pay off debts as they mourn your loss.

Insurance that helps life's moments move on

Life happens. Don't wait.

Sault Sainte Marie Chooses Life Insurance From State Farm

And State Farm Agent Leisa Mansfield is ready to help design a policy to meet you specific needs, whether you want coverage for a specific time frame or level or flexible payments with coverage designed to last a lifetime. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to experience what a company that processes nearly forty thousand claims each day can do for you? Reach out to State Farm Agent Leisa Mansfield today.

Have More Questions About Life Insurance?

Call Leisa at (906) 635-1593 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Leisa Mansfield

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.